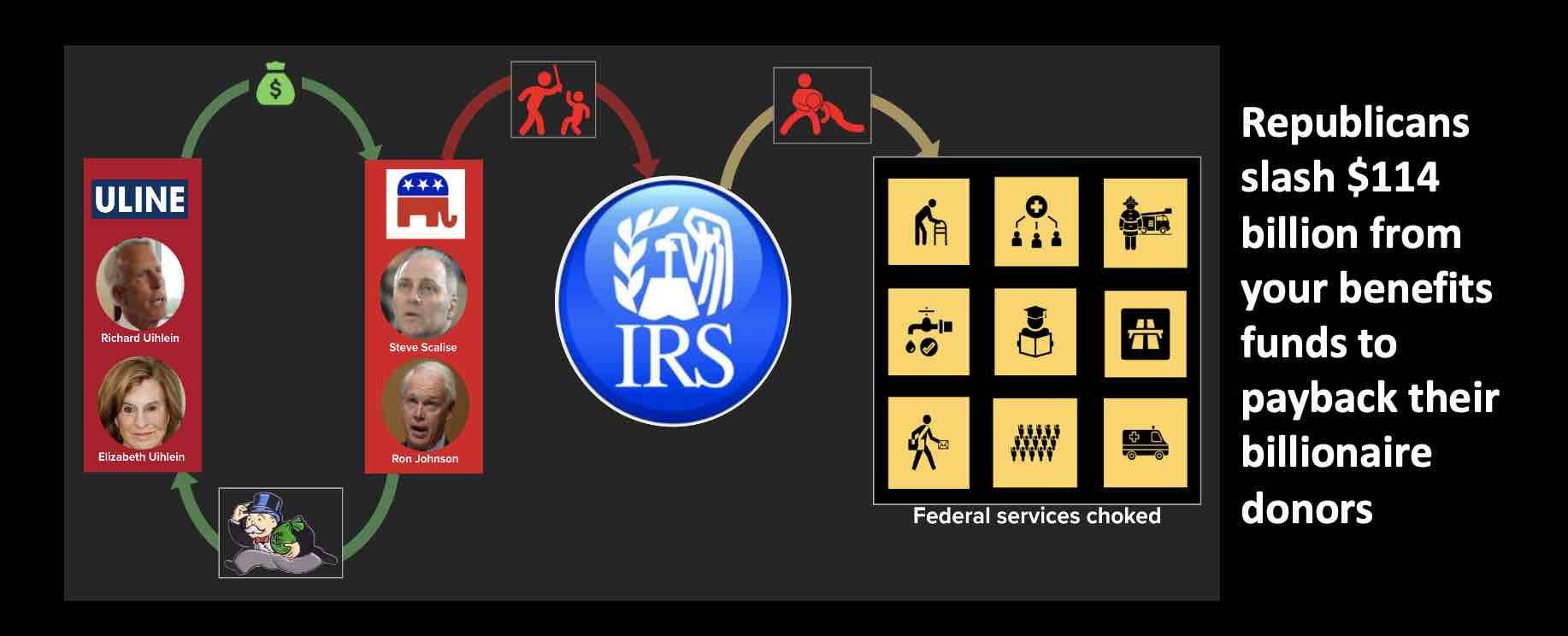

Republicans payback their billionaire donors with your money

How do billionaires keep getting richer, while your life gets harder? Follow the money to understand the scam.

House GOP passes repeal of IRS funding boost as its first bill in the majority – The Hill

It’s a giant tax cut for rich tax cheats. Bill #1 from the new House GOP. Adds to the deficit. – Ron Klain

“The Uihleins also spent $1,085,200 to support U.S. House Majority Whip Steve Scalise and his political committee. The Louisiana Republican objected to the certification of Biden electors from Arizona and Pennsylvania.” – Chicago Sun Times

Follow the money with this map to see how billionaires have rigged the system at the expense of working Americans.

Follow the money behind the GOP payback to their billionaire donors

Ron Johnson delivers for billionaires

GOP megadonors spend big to reelect Ron Johnson after he saved them $43 million in taxes. In 2017, Sen. Ron Johnson (R-WI) helped pass then-President Donald Trump’s Tax Cuts and Jobs Act and insisted that it include provisions that benefited so-called “pass-through” entities, companies that pay taxes through the personal filings of their owners. Among those who benefitted from the provisions were billionaires Richard and Elizabeth Uihlein, owners of the Uline shipping supply company, generous donors to Republicans and right-wing causes.

According to Federal Election Commission filings, in the first quarter of 2022, Elizabeth Uihlein, the president of Uline, donated $266,300 to Ron Johnson Victory, a joint fundraising committee benefiting Johnson and other Republican Senate candidates. Her husband Richard, the Uline CEO, kicked in another $10,800.” – American Indpendent

How billionaires are eating your lunch

“The GOP is fulfilling its election-year campaign promise to its wealthy donors to gut new tax enforcement funding provided to the IRS,” said Frank Clemente, executive director of Americans for Tax Fairness. “The new funds are being used to hold rich and corporate tax cheats accountable for paying the taxes they owe without raising a penny in taxes on people making under $400,000 a year. These funds are also necessary so that the IRS can provide quality services to taxpayers, such as sending them timely tax refunds and having their phone calls answered promptly.”

The GOP’s legislation would slash nearly $72 billion, or $9 out of every $10 in new dedicated funding, including:

- $45.6 billion for tax enforcement activities to catch wealthy and corporate tax cheats

- $25.3 billion in operations support for tax enforcement programs and taxpayer services, which is critical for ensuring taxpayers get refunds on time and phone calls answered

- $403 million for the Inspector General for Tax Administration, which promotes integrity, economy, and efficiency in the administration of our federal tax system

- $153 million to beef up the U.S. Tax Court to resolve taxpayer and IRS disputes

- $15 million for the IRS to prepare a report on what it would take to create a free, government-run tax e-filing system that would make it much easier for taxpayers to file their tax returns without paying a private service to help them

TakeAway: Stop the Republican pandering to billionaires for political donations, at the expense of everyone else. It’s time everyone pay their fair share of taxes.

Deepak

DemLabs

DISCLAIMER: ALTHOUGH THE DATA FOUND IN THIS BLOG AND INFOGRAPHIC HAS BEEN PRODUCED AND PROCESSED FROM SOURCES BELIEVED TO BE RELIABLE, NO WARRANTY EXPRESSED OR IMPLIED CAN BE MADE REGARDING THE ACCURACY, COMPLETENESS, LEGALITY OR RELIABILITY OF ANY SUCH INFORMATION. THIS DISCLAIMER APPLIES TO ANY USES OF THE INFORMATION WHETHER ISOLATED OR AGGREGATE USES THEREOF.

Read in browser »

Reposted from Democracy Labs with permission.