Student loans

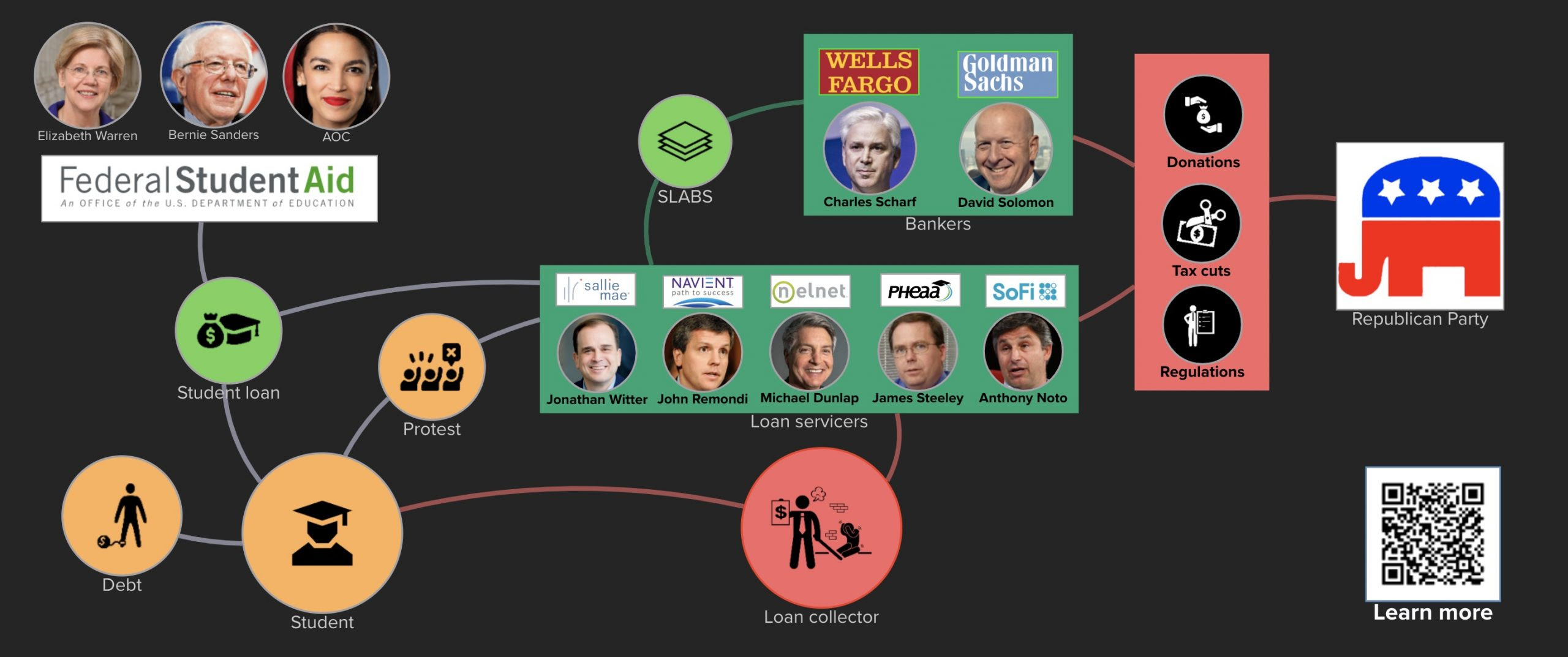

Financiers make billions while students are crushed by loans. Follow the money and political lobbying to see how the system is rigged.

“More than 40 million Americans have student debt, totaling at least $1.7 trillion. On average, borrowers out of school owe $36,000, with a monthly payment of $680. Roughly 11 percent of borrowers are in default. Overall, indebtedness discourages people from starting degrees, families and businesses, dragging everyone down.” – Rolling Stone

This results in students

– delaying home ownership

– causing generational wealth to decrease

– contributing to widespread depression and suicide

This relationship map shows how loans are created, packaged by loan processors into SLABS and resold to investors at huge profits. Students’ future income is the collateral behind these loans. But what happens if students cannot make their loan payments? Depression and suicides are increasing. Parents may be liable for their childrens’ loans. Meanwhile executives at loan processing firms make multi-million dollar salaries? Political donations gets them favorable regulations and tax cuts. How could cancelling student loans help millions of Americans?

Follow the money

Share this map freely with this link https://embed.kumu.io/d7ae2198432703bdde30f6cd47ae64fd

Embed it ins a website with this code < iframe src=”https://embed.kumu.io/d7ae2198432703bdde30f6cd47ae64fd” width=”940″ height=”600″ frameborder=”0″></iframe>

Making money of students

Student loans cannot be collateralized. With Mortgage-Backed Securities (MBS), the loans were collateralized by the house or property being purchased, but the “equity” in student loans is the borrower’s future expected earnings, which are difficult to quantify. … because of federal guarantees for FFEL loans and the 2005 bankruptcy laws, it is uncommon that the student loan companies will lose the value of their underlying investment, even when trends are showing that students are increasingly unable to pay their loans.”

“SLABS resulted from specific federal policy decisions. On November 27, 1992, the Securities and Exchange Commission adopted Rule 3(a)(7) of the Investment Company Act of 1940, which allows companies who issue asset-backed securities to be exempt from the legal definition of an “investment company.” This exemption permits companies to avoid asset registration fees and regulatory oversight – making it profitable for student loan companies (among others) to issue securities, which effectively created the market for SLABS. In total, $600 billion worth of SLABS have been issued, with $170 billion worth still outstanding.”- Open Democracy

Demands for change

“The student debt crisis is symptomatic of an unsustainable capitalist system. In the past several decades, the securitization of debt has become central to economic growth, but at what cost? As economist Michael Hudson has argued, “debts that can’t be paid, won’t be paid”, and the insistence of creditors to collect on those debts can trigger social unrest.

As the rational discontent of younger generations continues to grow, catalyzed by a lower quality of life than older generations, the accelerating climate crisis, and insurmountable student debt – activists may choose to utilize “the power of economic withdrawal.” Rather than endure the burden of unpayable debt, young people could exploit the vulnerabilities of the SLABS market via debt strikes or boycotts, as advocated during the Occupy Wall Street movement in 2011. Fear about the consequences of default may keep American student debtors from organizing such a strike, but greater public awareness about SLABS and the acceleration of present crises may incite more radical action.

Activists concerned about student debt should ask themselves: what would such a symbolic protest look like in the United States today, and could it become popular enough to pose a significant threat to the status quo?” – Open Democracy

Student outrage

Cancel Student Debt

“A decade ago, America committed trillions of dollars to bail out Wall Street banks, whose greed had cratered the economy. Now, it is time to commit a fraction of that to cancel the student debt that is crushing 45 million Americans and dragging down our economy. That means the average college senior graduates with over $30,000 in student debt—and more and more, this debt lasts a lifetime. Since 2004, the number of Americans 60 and over with student loan debt has more than quintupled—from 600,000 to 3.2 million—and tens of thousands of older borrowers have had their Social Security benefits seized by the government to pay for student loans.

Under our legislation to cancel all $1.6 trillion of student debt, the economy would get a boost of approximately $1 trillion over the next decade and up to 1.6 million new jobs would be created each year. At the same time, millions of Americans would have the financial resources they need to buy new homes, buy new cars, or open up small businesses. Moving forward, our legislation will also make every public college and university, historically black college and university, trade school, and apprenticeship program in America tuition-free and debt-free, because we understand that education must be an economic right for all, not a privilege for the few.” – Bernie Sanders in Fortune

TakeAway: Make it easier for students to see how they are being exploited and can mobilize to demand change.

Deepak

DemLabs

See this relationship map by scanning the QR Code.

Reposted from Democracy Labs with permission.